Nevada requires every driver to carry auto insurance—but simply buying the bare minimum is often not enough to truly protect yourself or your family. Understanding Nevada’s minimum car insurance requirements helps you stay legal on the road and make smart choices about how much coverage you really need.

While car minimums are a starting point, many Nevada drivers find that they don’t offer enough protection in real-world situations. Need legal guidance? Call us at Howard Injury Law 24/7 at (702) 331-5722 for a free consultation or fill out our 24/7 web form.

Nevada’s Minimum Car Insurance Requirements

If you register or drive a vehicle in Nevada, you must carry at least the state‑mandated liability coverage. These are sometimes written as 25/50/20 and include:

- 25,000 for bodily injury or death to one person in a single accident

- 50,000 total for bodily injury or death to two or more people in a single accident

- 20,000 for property damage to someone else’s vehicle or other property in a single accident

This liability insurance is designed to pay other people’s losses when you are at fault—not your own medical bills or damage to your car. You must also be able to show proof of insurance to register your vehicle and if you are stopped by law enforcement.

If your coverage lapses—even for a short time—the DMV’s electronic verification system can trigger registration suspensions, reinstatement fees, and other penalties. Keeping continuous coverage that meets at least these minimums is required to stay legal on Nevada roads.

Why the Minimum Often Isn’t Enough

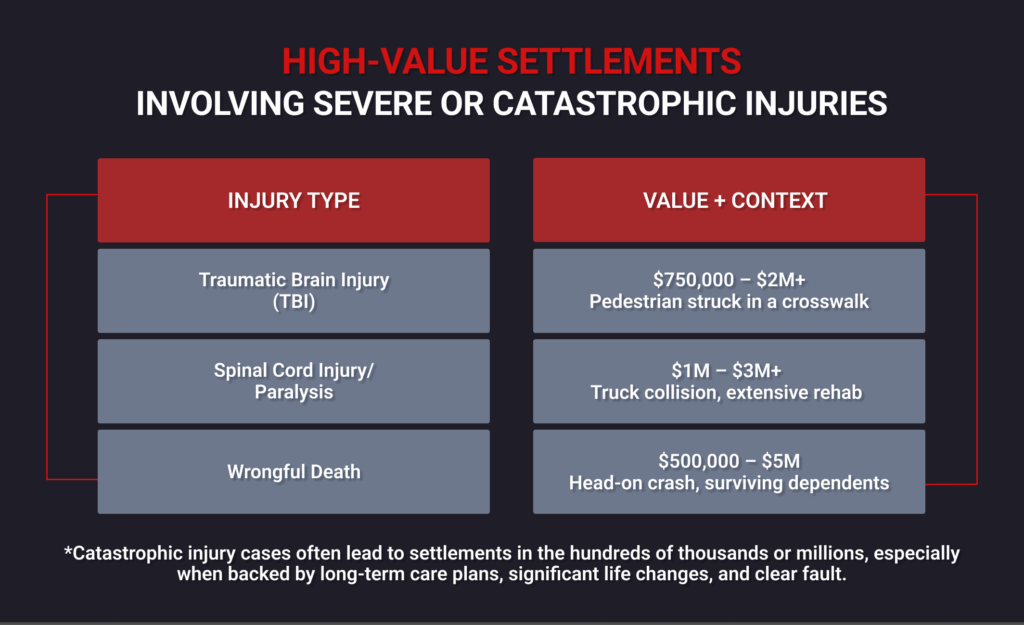

Nevada’s minimum car insurance requirements are a legal baseline, not a guarantee of full protection. Real‑world crashes in Las Vegas quickly reveal how limited 25/50/20 coverage can be.

Medical bills can exceed minimum limits fast

Hospital care is expensive. A single ER visit with imaging, follow‑up appointments, and basic rehab can easily surpass 25,000 for one injured person. More serious injuries involving surgery, intensive care, or long‑term therapy can cost many times that.

If you cause a crash and the other driver racks up 100,000 in medical expenses, but your policy only covers 25,000 per person:

- Your insurance may pay 25,000

- The injured person can pursue the remaining 75,000 directly from you

That difference can lead to lawsuits, wage garnishment, liens against property, and serious financial stress.

Property damage is more expensive than ever

Modern cars—especially luxury vehicles and electric cars—are expensive to repair. A serious car collision can total a vehicle or require 20,000 or more in repairs. If you cause a multi‑car crash or hit a high‑value vehicle, a 20,000 property damage limit may not stretch very far.

When your limits run out, you are personally responsible for the remainder.

Why Many Drivers Choose Higher Limits

Because of these risks, many Nevada drivers decide to carry more than the minimum. A common recommendation is 100/300/50:

- 100,000 per person for bodily injury

- 300,000 per accident for bodily injury

- 50,000 per accident for property damage

Higher car insurance limits give you more protection if you cause a serious accident, especially if you:

- Own a home or have significant savings

- Have a higher income that could be targeted in a lawsuit

- Regularly drive in heavy traffic, long commutes, or high‑risk areas

- Want peace of mind that one crash will not wipe out years of hard work

Many people are surprised to learn that raising liability limits is often less expensive than they expect—sometimes just a modest increase in monthly premiums for much stronger financial protection. It is worth asking your insurance agent for quotes at higher levels, not just the minimum.

The Role of Uninsured and Underinsured Motorist Coverage (UM/UIM)

Liability coverage protects others when you are at fault. But what happens if you are hit by a driver who has no insurance—or only the minimum?

That is where uninsured/underinsured motorist (UM/UIM) coverage comes in.

How UM/UIM works

UM/UIM coverage is designed to pay for your injuries (and those of your passengers) when:

- The at‑fault driver has no insurance at all (uninsured), or

- The at‑fault driver’s limits are too low to cover your full losses (underinsured)

Example:

You suffer 150,000 in injury‑related damages. The at‑fault driver carries only 25,000 in bodily injury liability. Their insurer pays that 25,000, but you still have 125,000 in uncompensated losses. If you have a 100,000 UM/UIM policy, it can step in to cover much or all of that remaining amount (depending on your policy language and offsets).

Why UM/UIM is especially important in Nevada

Some Nevada drivers:

- Carry only the minimum required coverage

- Let their policies lapse

- Ignore the law and drive with no insurance

If one of them hits you, your own UM/UIM coverage can be the difference between manageable finances and overwhelming debt. Because of this, many legal and insurance professionals recommend:

- Matching your UM/UIM limits to your liability limits (for example, 100/300 instead of 25/50)

- Treating UM/UIM as essential coverage, not an optional luxury

Talk with your agent about how much UM/UIM you currently have and what it would cost to increase it.

Other Helpful Coverages Beyond the Minimum

Nevada’s minimum car insurance requirements only involve liability, but you may want other protections to cover your injuries and your vehicle.

Medical payments coverage (MedPay)

MedPay helps pay medical expenses for you and your passengers after a crash, regardless of who was at fault. It can cover:

- ER visits and urgent care

- Doctor appointments and diagnostic tests

- Deductibles and co‑pays from your health insurance

This coverage can also apply if you are a pedestrian struck by a car. It is usually sold in smaller amounts (for example, 5,000–10,000), but it can make a big difference with upfront costs.

Collision and comprehensive coverage

If your car is financed or leased, your lender probably requires collision and comprehensive coverage. These optional protections help pay for:

- Collision: Damage to your own vehicle from a crash, regardless of fault

- Comprehensive: Non‑collision damage such as theft, vandalism, fire, or certain weather events

While not part of Nevada’s minimum requirements, they are crucial if you could not easily replace or repair your vehicle out of pocket.

Penalties for Driving Without Required Insurance

Complying with Nevada’s minimum car insurance requirements is not optional. If you let your policy lapse or drive without coverage, you could face:

- Registration suspension

- Reinstatement fees and fines based on the length and number of lapses

- Potential driver’s license consequences in serious cases

Because the DMV verifies insurance electronically, a lapse can trigger penalties even if you have not been pulled over. That is why it is important to:

- Keep your policy active

- Update your information promptly if you change insurers

- Make sure your name and Vehicle Identification Number (VIN) match between your policy and registration

Failing to maintain coverage can cost far more in penalties and risk than simply keeping a valid policy in place.

How to Choose the Right Coverage

Meeting Nevada’s 25/50/20 minimums keeps you legal; but choosing the right coverage keeps you protected. When deciding how much insurance to buy, consider:

- Your assets: Do you own a home, savings, or investments you want to protect?

- Your income: Higher future earnings can be targeted in lawsuits if your insurance is too low.

- Your vehicle: Is it new, financed, or expensive to repair?

- Your driving habits: Do you drive daily in busy Las Vegas traffic or only occasionally?

- Your budget: How much can you comfortably afford in monthly premiums versus potential out‑of‑pocket costs after a crash?

In many cases, increasing your liability and UM/UIM limits to at least 100/300/50, adding MedPay, and carrying collision/comprehensive coverage if you need it strikes a better balance between cost and protection than the state minimum alone.

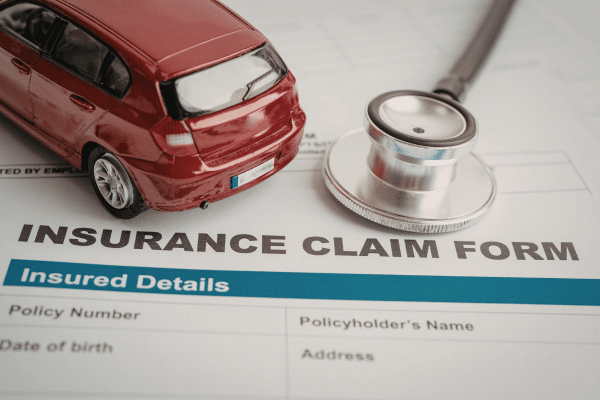

Talk to Howard Injury Law After a Serious Crash

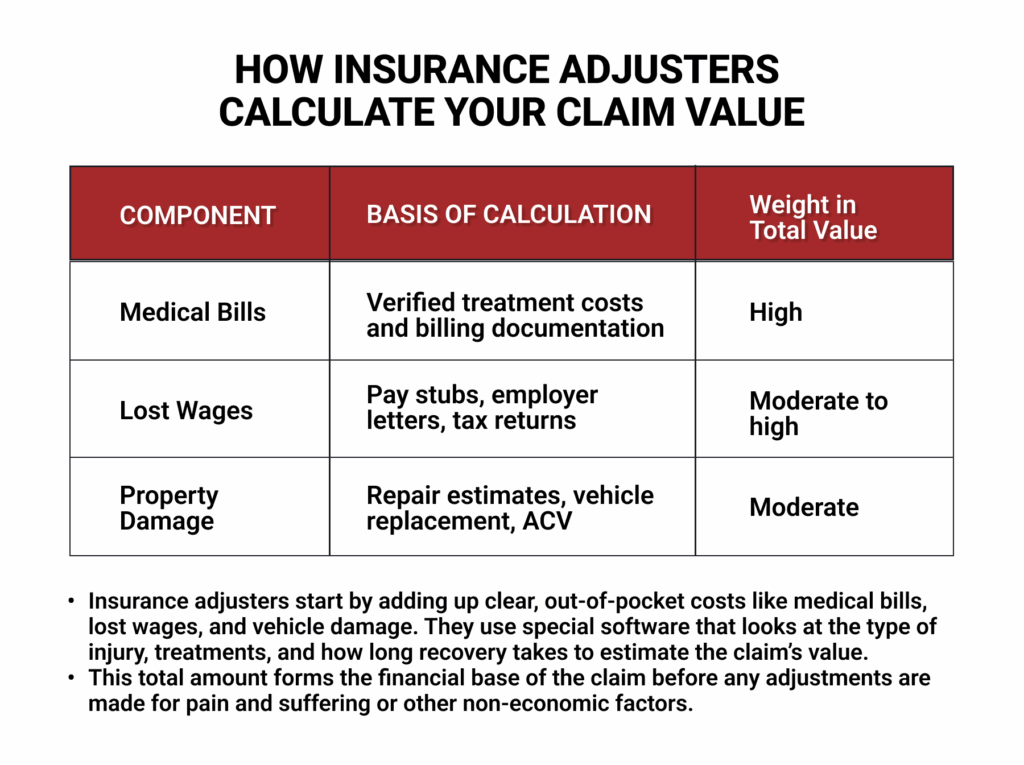

Even with good insurance, things can get complicated after a collision. Claims can be delayed, undervalued, or denied; multiple policies may apply; and you may be unsure whether settlement offers are fair.

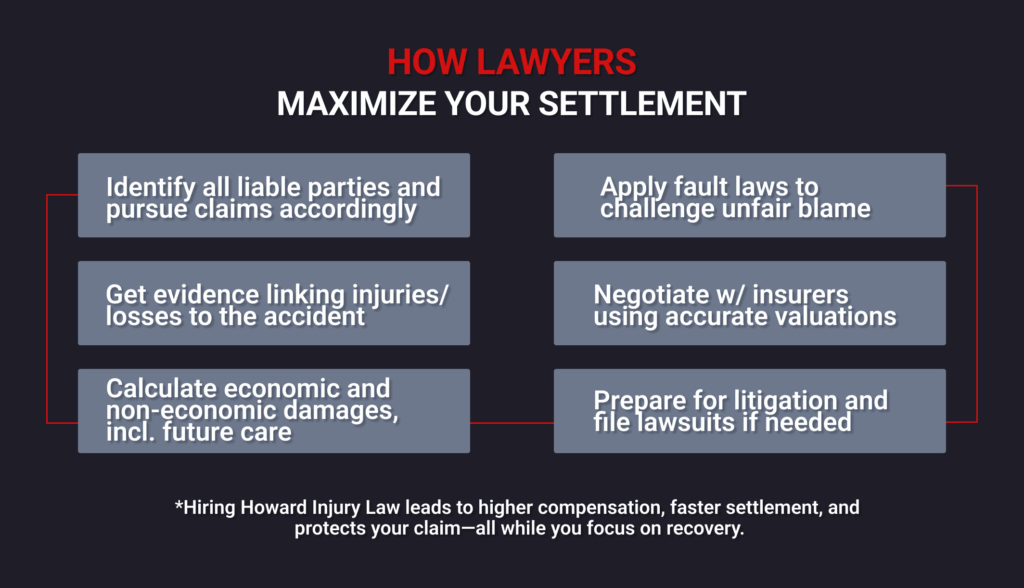

If you are dealing with significant injuries or damages after a crash in Nevada, a conversation with a lawyer can help you:

- Understand how Nevada’s minimum car insurance requirements affect your case

- Identify all available insurance coverages and policy limits

- Challenge low offers and unfair fault assignments

- Pursue additional compensation when another driver’s minimum policy is not enough

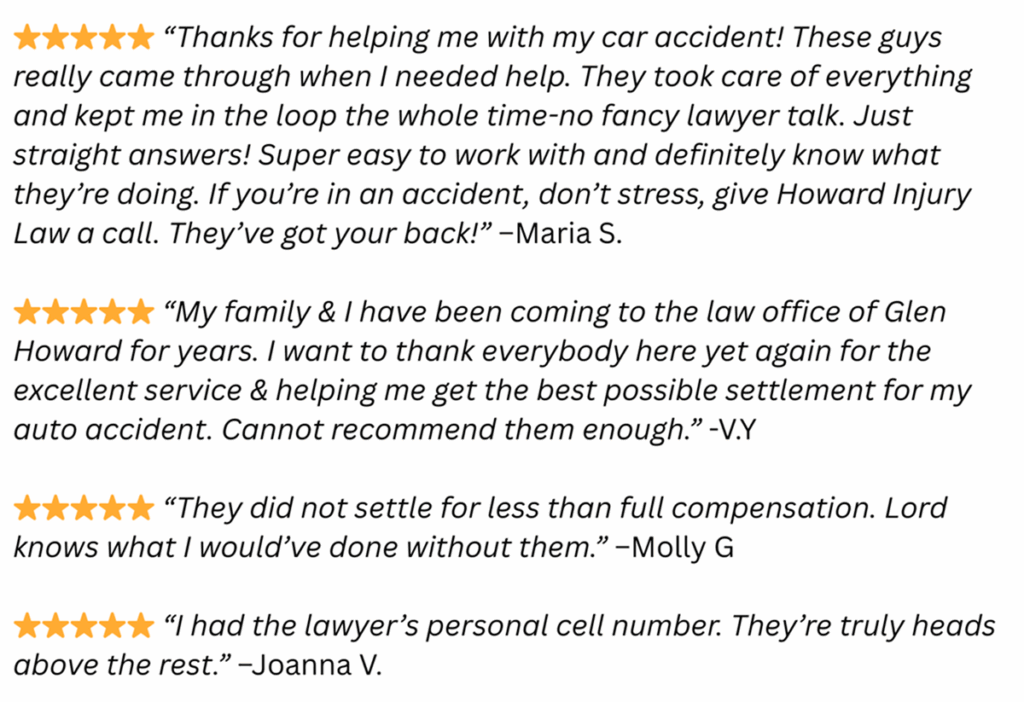

Howard Injury Law has extensive experience handling auto accident claims across Las Vegas and the surrounding communities. We’re here to ensure that your rights are protected every step of the way. Call or fill out our free online form!

Free Consultation with Howard Injury Law:

📲 (702) 331-5722

🗣 Se Habla Español

🗣 Wǒmen shuō pǔtōnghuà hé yuèyǔ

🚀 Highly recognized by Avvo and named among NAOPIA’s Top 10 Personal Injury Attorneys in Nevada, along with many other prestigious awards. We’re the trusted Las Vegas car accident law firm with elite trial strength when your future is on the line!

🔍 Searching for the best Las Vegas car accident lawyer, car injury lawyer, or top personal injury lawyer near me?

🏛️ Find us on Justia, Yelp and Google Maps.

📱 Follow us on Instagram, Facebook, TikTok, or X for ongoing community news, updates, and personal injury safety tips.